Contribution Limit 457b 2025

Contribution Limit 457b 2025. That’s an increase of $500 over 2025. More people will be able to make contributions to roth.

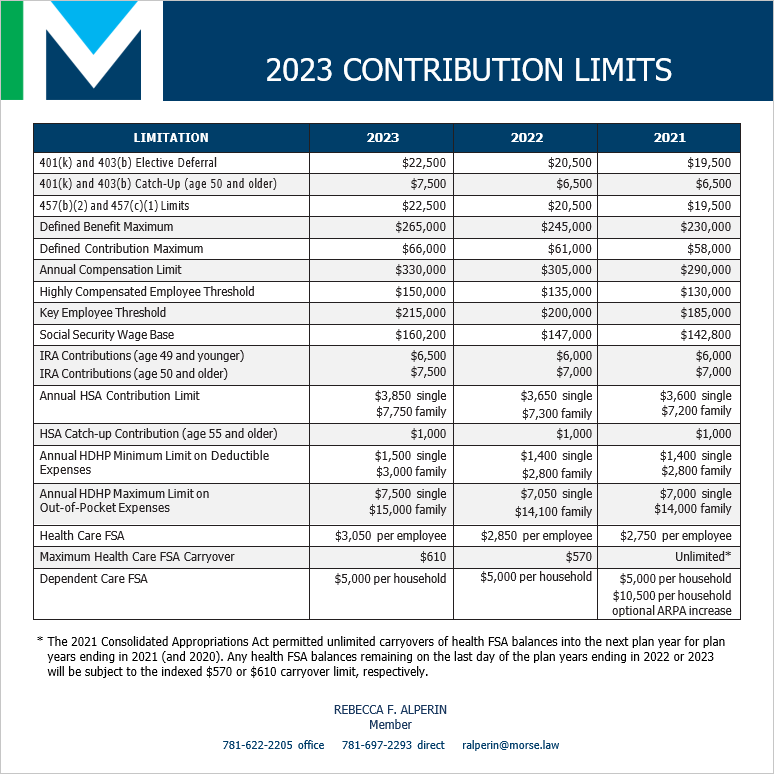

457b plan maximum contribution amounts for 2025 for 2025, 457b plan maximum contribution amounts are: The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2025.

Maximum 457 B Contribution 2025 Over 65 Grier Kathryn, The maximum amount you can contribute to a 457 retirement plan in 2025 is $23,000, including any employer contributions.

457b 2025 Contribution Limits Libby Othilia, The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

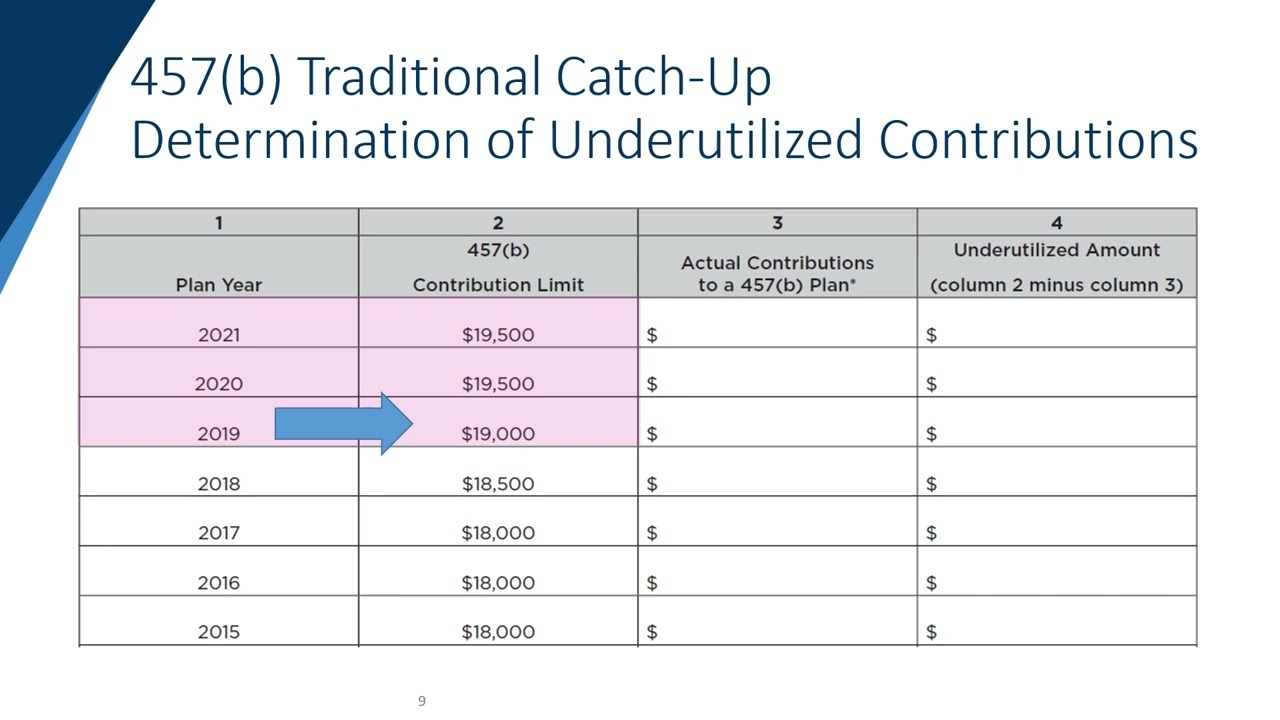

Contribution Limit 457b 2025 Calendar Melly Sonnnie, Make an additional contribution—up to a grand total of $45,000 for 2025 or up to $46,000 in 2025—if you're within three years of your normal retirement.

457b 2025 Contribution Limits Libby Othilia, For 2025, the basic contribution limit is $23,000.

457b Contribution 2025 Marci Ruthann, Annual contributions to a code §457 (b) plan sponsored by a nonprofit can’t exceed the lesser of:

457b Limits 2025 Tansy Florette, Annual contributions to a code §457 (b) plan sponsored by a nonprofit can’t exceed the lesser of:

457b 2025 Contribution Limit Irs Aleen Aurelea, The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Max Contribution To 457b 2025 Pier Ulrica, More people will be able to make contributions to roth.

Maximum 457b Contribution 2025 Over 50 Vania Janeczka, Every year, the irs announces the latest.